Stamp Duty Calculator - Stamp Duty in Delhi

| = | ||

Certainly! Here is a brief overview of Stamp Duty in India:

Stamp Duty in India is a type of tax levied by state governments on various transactions, including property purchases, share transfers, and certain legal documents. The purpose of Stamp Duty is to ensure the legal validity of these agreements and generate revenue for the government.

In the context of property transactions, Stamp Duty is a significant cost that buyers need to consider when purchasing real estate. The rate of Stamp Duty varies across different states in India and is usually based on the property's market value or the transaction amount, whichever is higher.

To calculate the Stamp Duty payable on a property purchase, buyers can refer to the state government's official website or consult with a registered property advisor. It's essential to accurately determine the Stamp Duty to avoid any legal complications or penalties in the future.

Overall, Stamp Duty plays a crucial role in regulating property transactions and ensuring compliance with legal requirements in India. Buyers and sellers alike should be aware of the applicable rates and regulations to facilitate smooth and lawful transactions.

If you have any specific questions or need more detailed information on Stamp Duty in India, feel free to ask!

Try our Stamp Duty Calculator to claculate exact amount you have to pay for your property while registering in India & its states

Generate FREE Property Leads

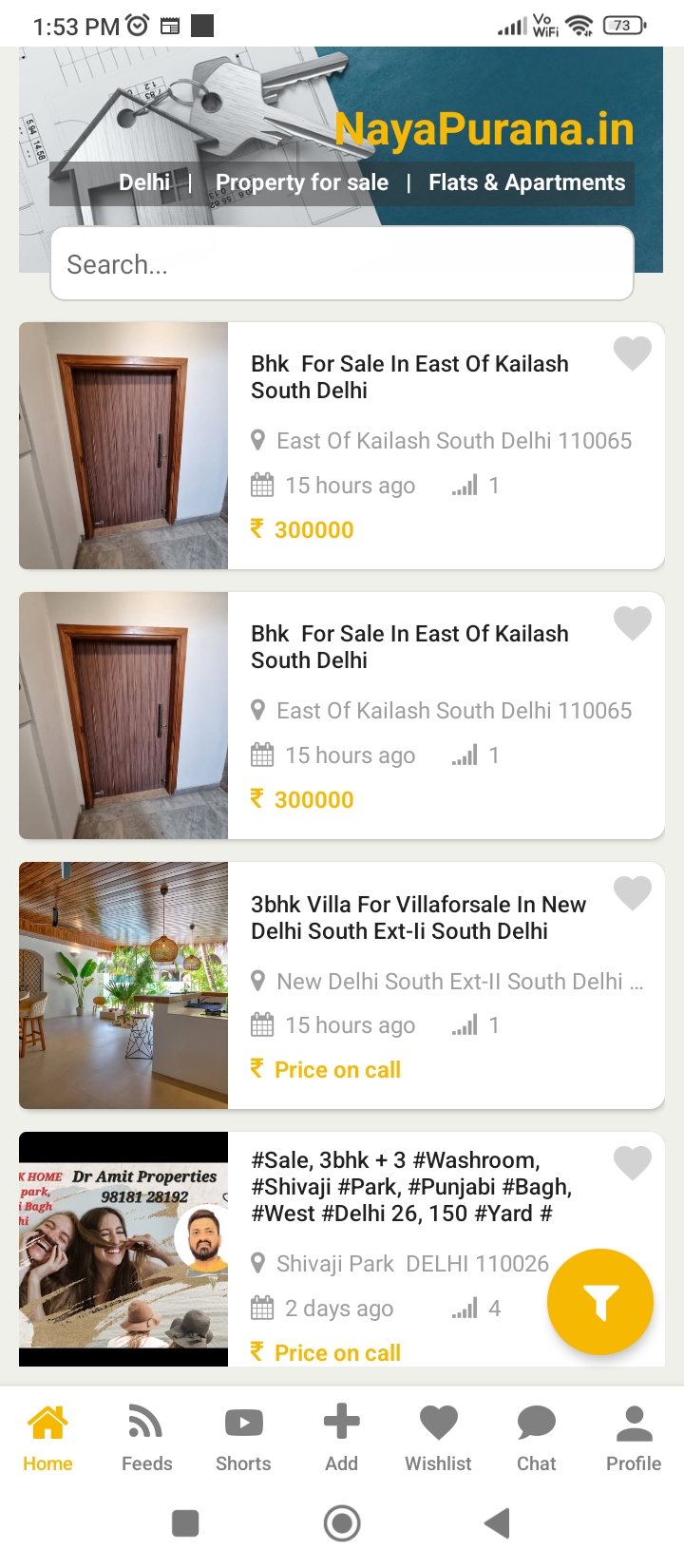

Engage with India's largest proptech social community of 10 Lakh+ buyers, sellers, and builders to get unlimited free property leads, expand your network, and grow your business faster!

Join NowTop Performers

Unlock Premium Features

Go Premium to showcase your property with map locations, videos, and full details for maximum visibility.

- Appear in more filtered searches by buyers

- Priority placement in listings

- Upload unlimited photos & high-quality videos

- Verified badge & premium support

Ready to Supercharge Your Business?

NayaPurana.in helps you list for free - but our Premium Membership gives you the competitive edge to grow faster, build stronger networks, and stand out in your market!

- Get noticed first by potential buyers

- Verified badge to build instant trust

- Priority visibility in search results

- More leads = More sales opportunities

- Professional profile that attracts quality connections

- 1000 FREE NPX Coins in Wallet

- Google Ads FREE

- 10X Profile Booster

- Short Videos Promotion

- Personal Leads capture Form